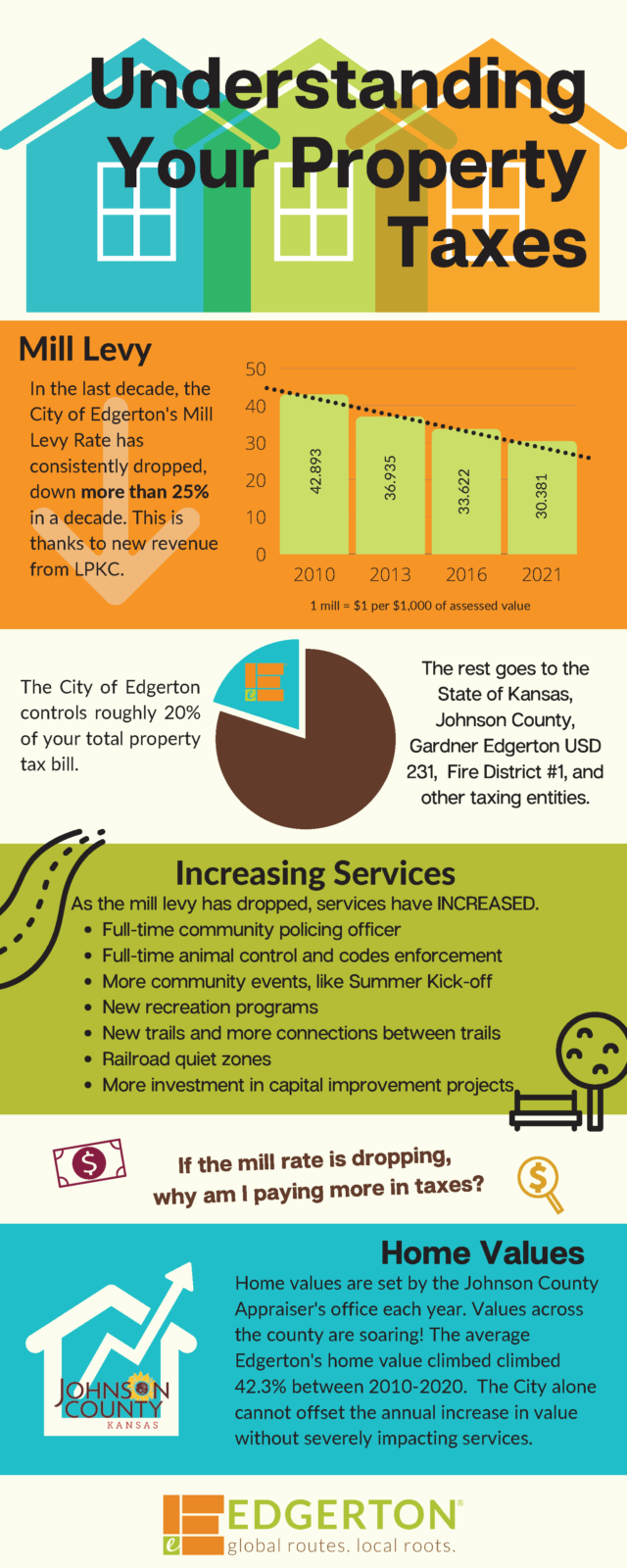

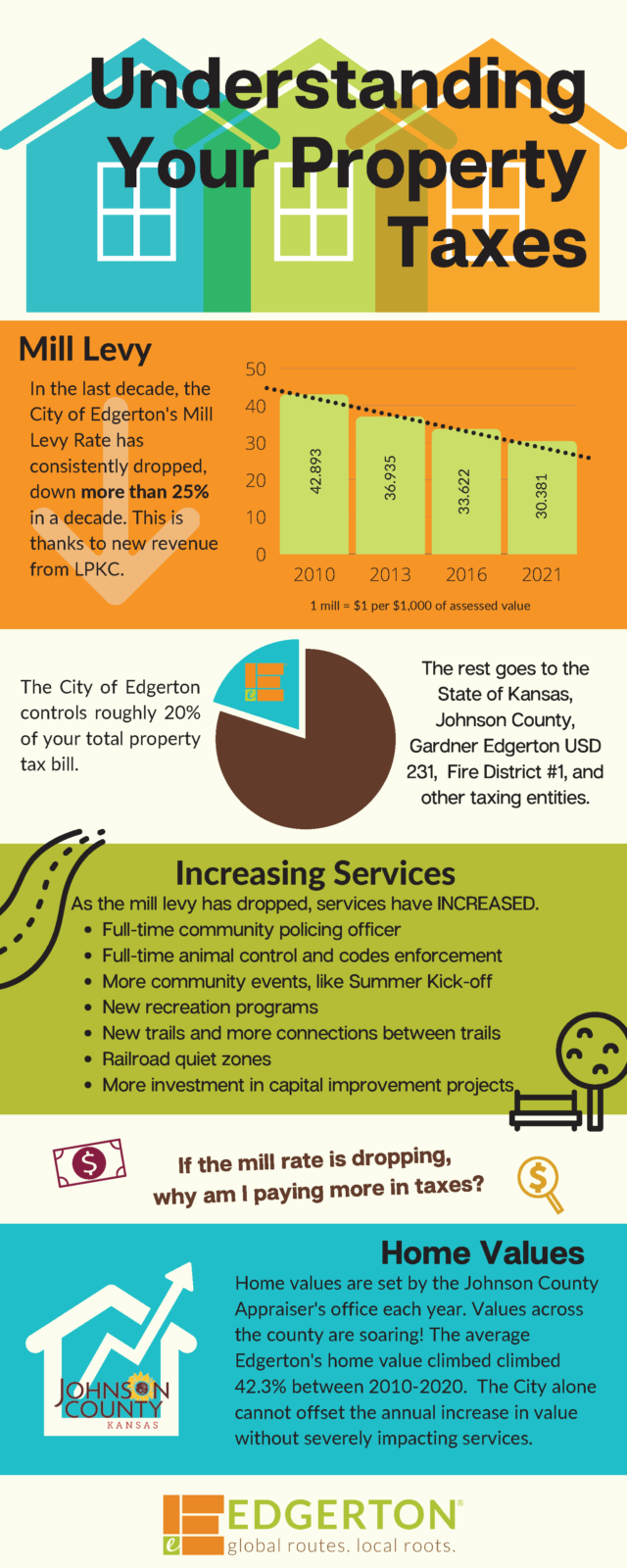

The City of Edgerton is in Johnson County, Kansas. The County assesses and collects all property taxes. For more details about your property taxes from Johnson County, click here.

The City of Edgerton is in Johnson County, Kansas. The County assesses and collects all property taxes. For more details about your property taxes from Johnson County, click here.